Quick Menu

Quick Menu

|

Welcome to the new PAYE Calculator reflecting the change in the Personal Income Tax Regime. |

||||

| 1. Enter your Monthly, Fortnightly or Weekly Gross Pay/Salary | ||||

|---|---|---|---|---|

| 2. Tick the "For Year 2023?" box | ||||

| 3. Enter your Tax Code | ||||

| 4. Tick the "NIC" box if any is deducted | ||||

| 5. Click "Calculate" | ||||

| 6. You can also customize your calculations with the other options available |

PAYE CALCULATOR |

|

To determine the amount of tax to be deducted from a salary: |

||||

| 1. Enter your Monthly, Fortnightly or Weekly Gross Pay/Salary | ||||

|---|---|---|---|---|

| 2. Enter your Tax Code | ||||

| 3. Tick the "NIC" box if it is deducted | ||||

| 4. Click "Calculate" | ||||

| 5. You can also customize with the other options available |

PAYE CALCULATOR |

|

MARCH 31, 2026 | 11:59PM

248 Days

|

|

Select a tab of frequently asked questions according to the category they fall in to get an immediate response to your inquiry

Who must file Income Tax Returns?

- Every resident individual who is in receipt of income of over $18,400 in any year;

- All self-employed individuals, notwithstanding the amount of the income or loss. Individuals in this case include taxi and mini-bus owners or drivers, doctors, mechanics, shopkeepers, vendors, lawyers, hairdressers, shop-owners, contractors, etc.;

- Every corporation, whether or not a profit is made;

- Corporations and Individuals to whom exemption of Tax has been granted under the Fiscal Incentive Act or otherwise;

- Partnerships.

If an individual has failed to submit Income Tax Returns for several years, what is his or her obligation in respect of those missing years?

Any person liable to furnish a return of income, in respect of any year of income, who fails, neglects or Inland Revenue Department requires that returns be submitted for the last six years.

Should an income tax return still be submitted if, in any year of income, a small business or a company suffers a loss?

Yes. An income tax return should be filed by a small business or a company whether or not the net result is a loss. A financial statement including Income Tax Computation showing details of the loss must be attached to the return and the actual loss shown on the return in brackets. A loss arises when the allowable business expenses exceed the income earned.

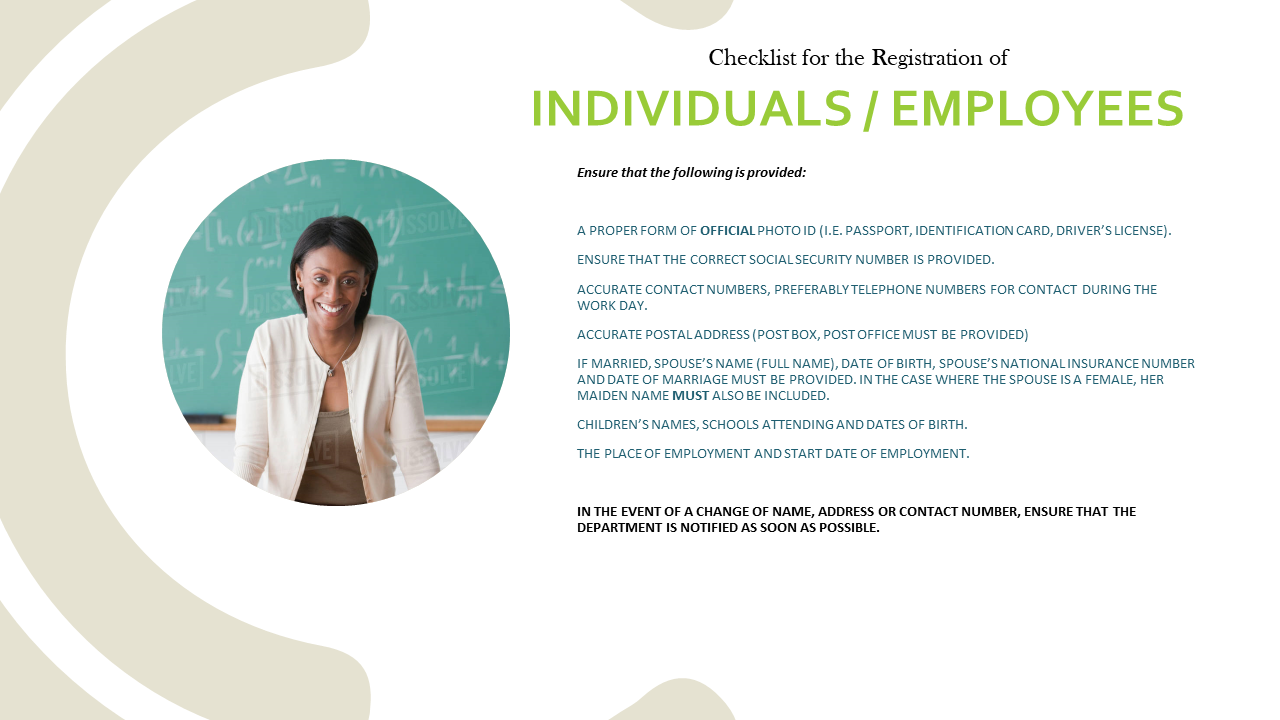

What are the requirements for registration?

Individuals

A completed and signed registration form should be submitted along with any of the following forms of identification:

Passport, Drivers Licence, National ID, NIC card.

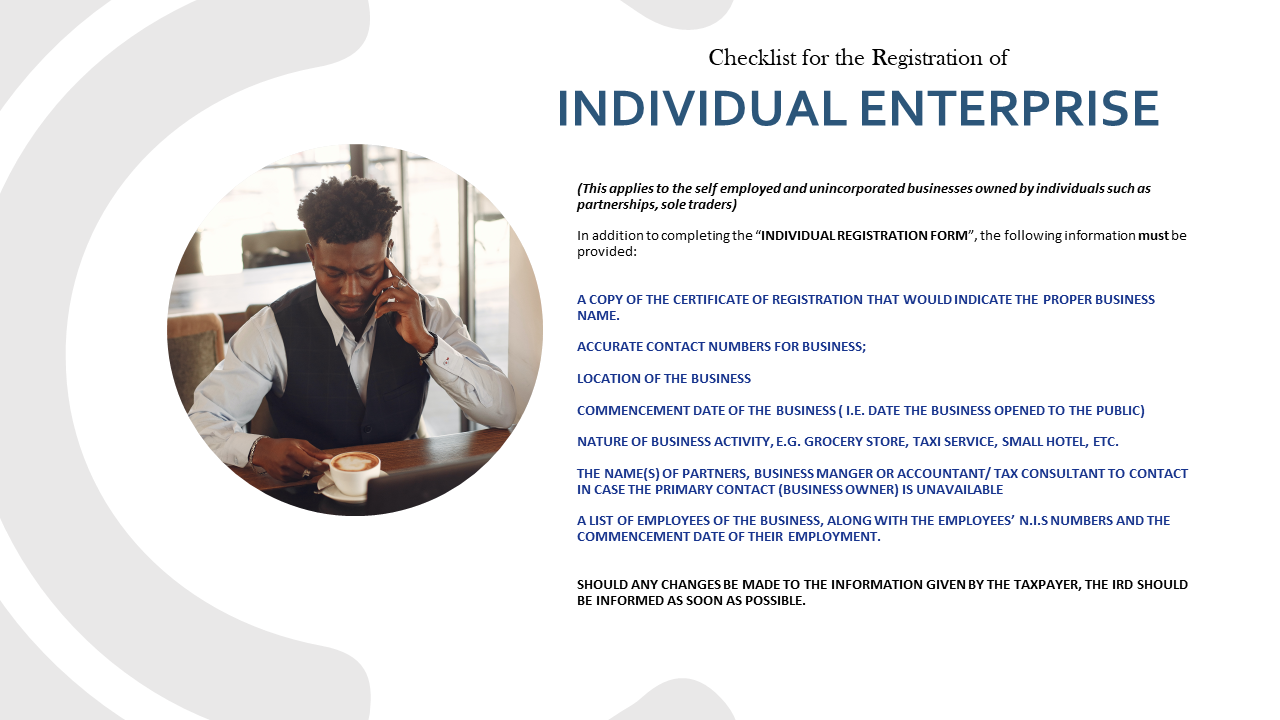

Self-Employed persons

In addition to the completed registration form and a valid ID as indicated above, a self-employed individual is required to submit a certification of registration for their business.

Partnership

The registration for the partnership signed a partner must be submitted along with:

- Certificate of registration for the partnership;

- NIC number for each partner.

Companies

The completed registration form signed by a director or the company secretary must accompany:

- the certificate of incorporation;

- a list of employees with their NIC numbers and the date of employment with the company.

Where should I register?

Taxpayers may register at any of our locations

What is a Tax Account Number (TAN)?

A Tax Account number is a unique eight-digit identification number assigned to an individual taxpayer, a business enterprise, a company (partnership) by way of an automated system. A Taxpayer will require this number when transacting business with either of the revenue collecting departments.

Why the TAN?

The Inland Revenue uses a fully computerised tax system called the Standardised Integrated Government Tax Administration System (SIGTAS). SIGTAS is a fully-networked system running on a modern database. The computerization of operations with the department helped improve the tax administration and ultimately provide better services to the public.

Under the TAN system, all taxpayers have a unique identification number which must be used when transacting business with the Inland Revenue Department, as well as the Customs Department.

The TAN will:

- Create and maintain accurate files for taxpayers;

- Eliminate the duplication of information on taxpayers within the department.

Who needs a TAN?

ALL TAXPAYERS doing business with the Revenue Departments need a Tax Account Number (TAN).

Taxpayers (Individuals, Partnerships and Companies) are required to register and receive a TAN by completing the relevant registration forms.

A taxpayer discovers that he has been given two Tax Account Numbers (TAN). What must he do?

The taxpayer should come in to the Tax Intelligence of the Inland Revenue Department with his St. Lucian identification card or NIC card and notify an officer of the Section. He will then be told which is his correct number and this number should be the one used at all times.

When a taxpayer changes his or her name and/or address, how is Inland Revenue notified?

The taxpayer should write or call the Tax Intelligence of Inland Revenue Department to notify the Section of the change.

What are some factors which delay the normal processing of a return?

The most frequent ones are Income Tax Returns without:

- Tax Account Numbers

- Addresses

- Signatures

- Complete or correctly filled information

- Certificates of remuneration and PAYE deductions

- The relevant supporting documents, as indicated in the instructions accompanying the Income Tax Return form

I am self-employed and was not aware that I had to submit yearly returns. On applying for a letter of exemption Re: 10% Contract Tax, I was told that I had to file my income tax returns for the last six (6) years. Is this correct?

It certainly is. Every self-employed person, whether or not he or she has made a profit, must file an income tax return every year. It should be noted that self-employed persons must pay their taxes yearly, in advance on a quarterly basis and the balance of tax estimated by him should be paid by March 31 of the following year. The dates of payment are March 25, June 25 and September 25.

My business operations ceased during the year. Am I still obligated to file an Income Tax Return Form?

Yes. Section 73 (b) of the Income Tax Act of 1989 requires that a person who ceases to carry a business during any year should file an Income Tax Return Form for the period of time in which the business was in operation prior to its closure.

I am leaving St. Lucia in September to pursue studies; should an Income Tax Return Form be filed for the period that I was employed?

Yes. An Income Tax Return Form should be submitted to the Department. However, if income is being received while you are away at school, returns should be filed by March 31, of the following year.

I understand that there is a 5% late filing penalty but I am unable to meet the filing deadline. What can I do to avoid this penalty?

You may apply to the Comptroller in writing, requesting an extension of time stating the reasons and the required extended date. It must be noted however, that an extension of time must be requested prior to the due date. The Department would appreciate that requests for extensions be filed at least one month in advance of the due date.

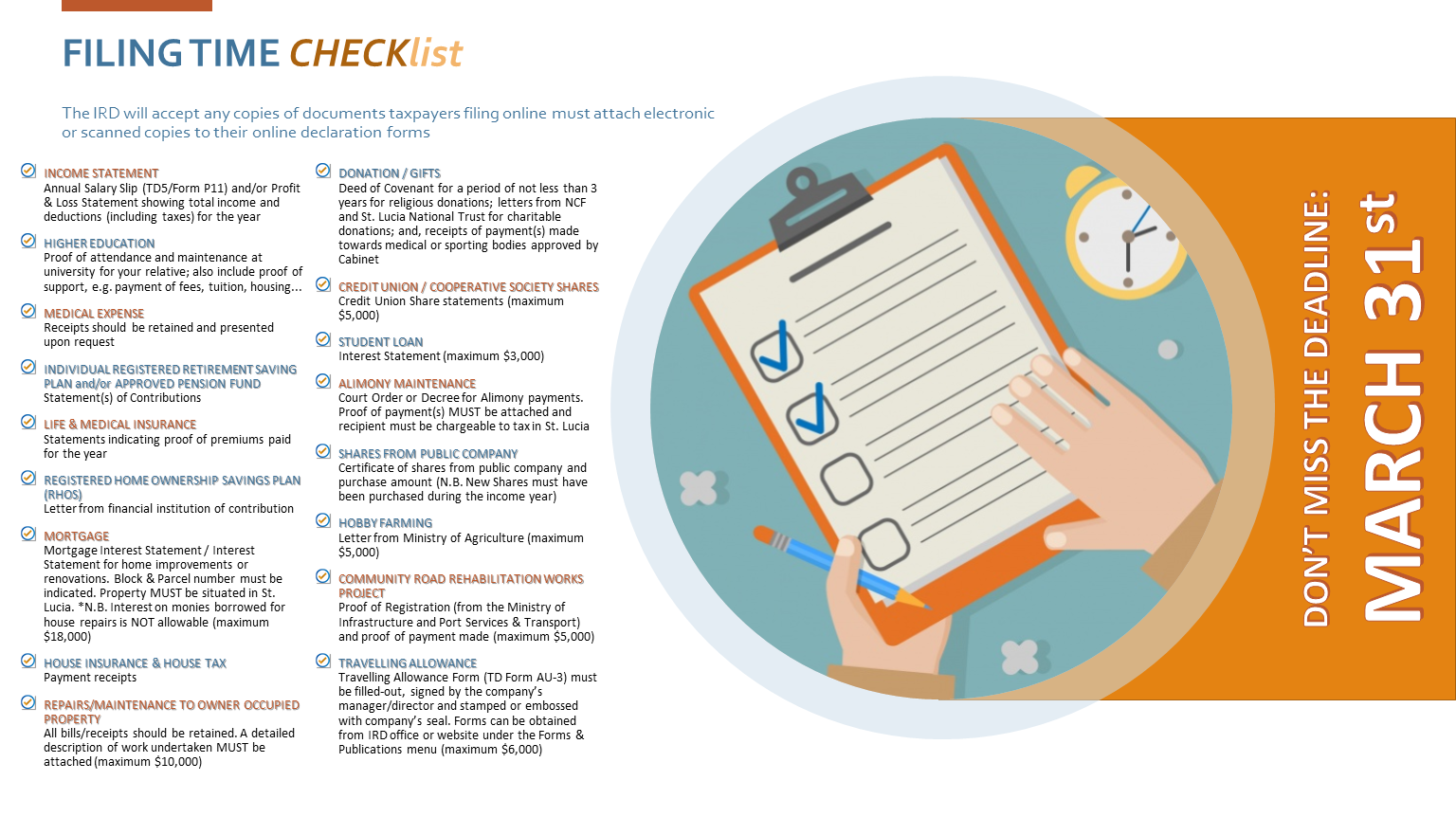

Select a tab to observe the checklist of important documents when making submissions to the IRD