Quick Menu

Quick Menu

Property Tax Declaration

Declaration of Commercial Properties

Declarations to be made by Owners of Commercial Property

1. Prescribed Form

Section 16 of the Land & House Tax Act requires all commercial property owners to submit to the Department a valuation report on a Prescribed Form.

2. Commercial Valuation

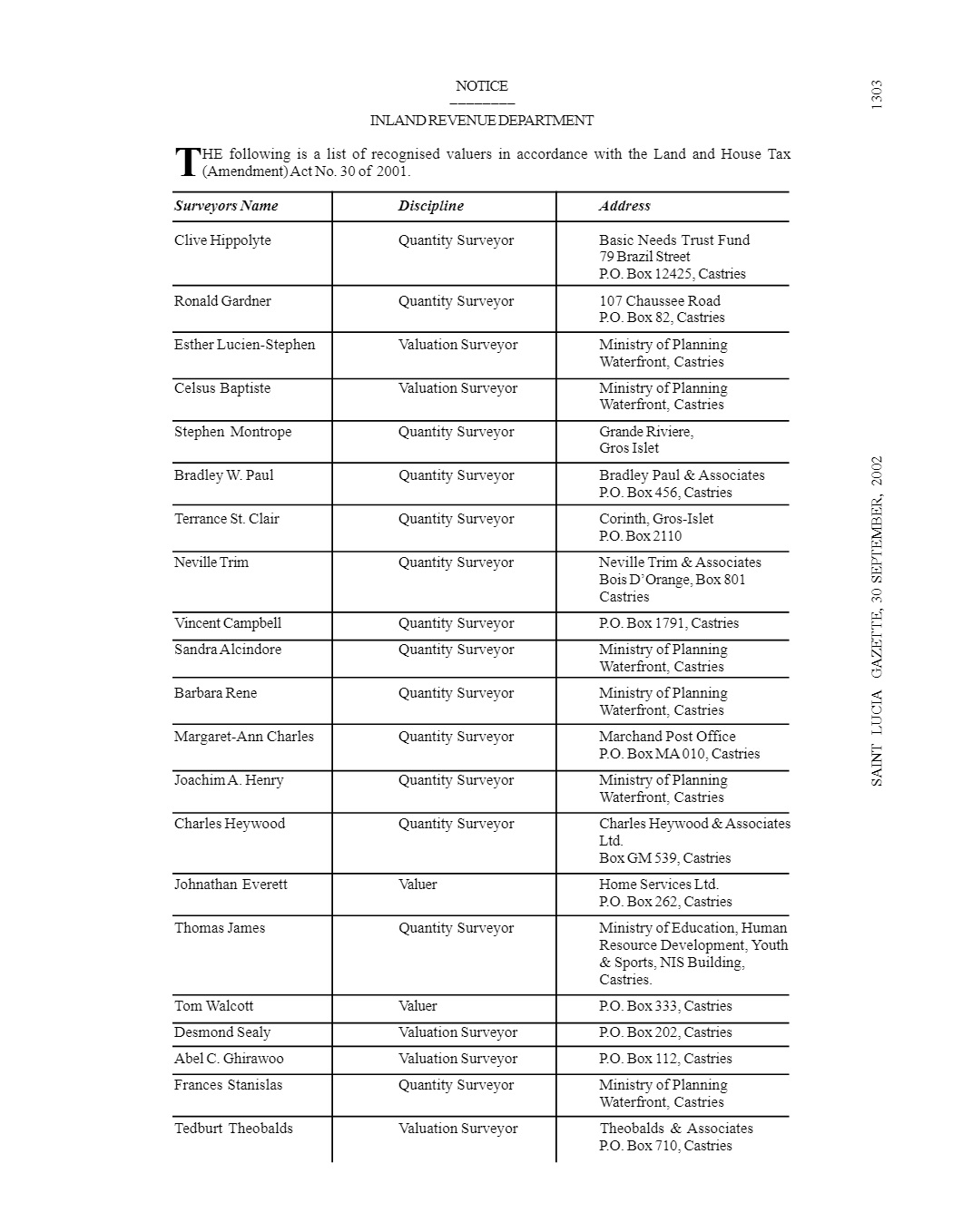

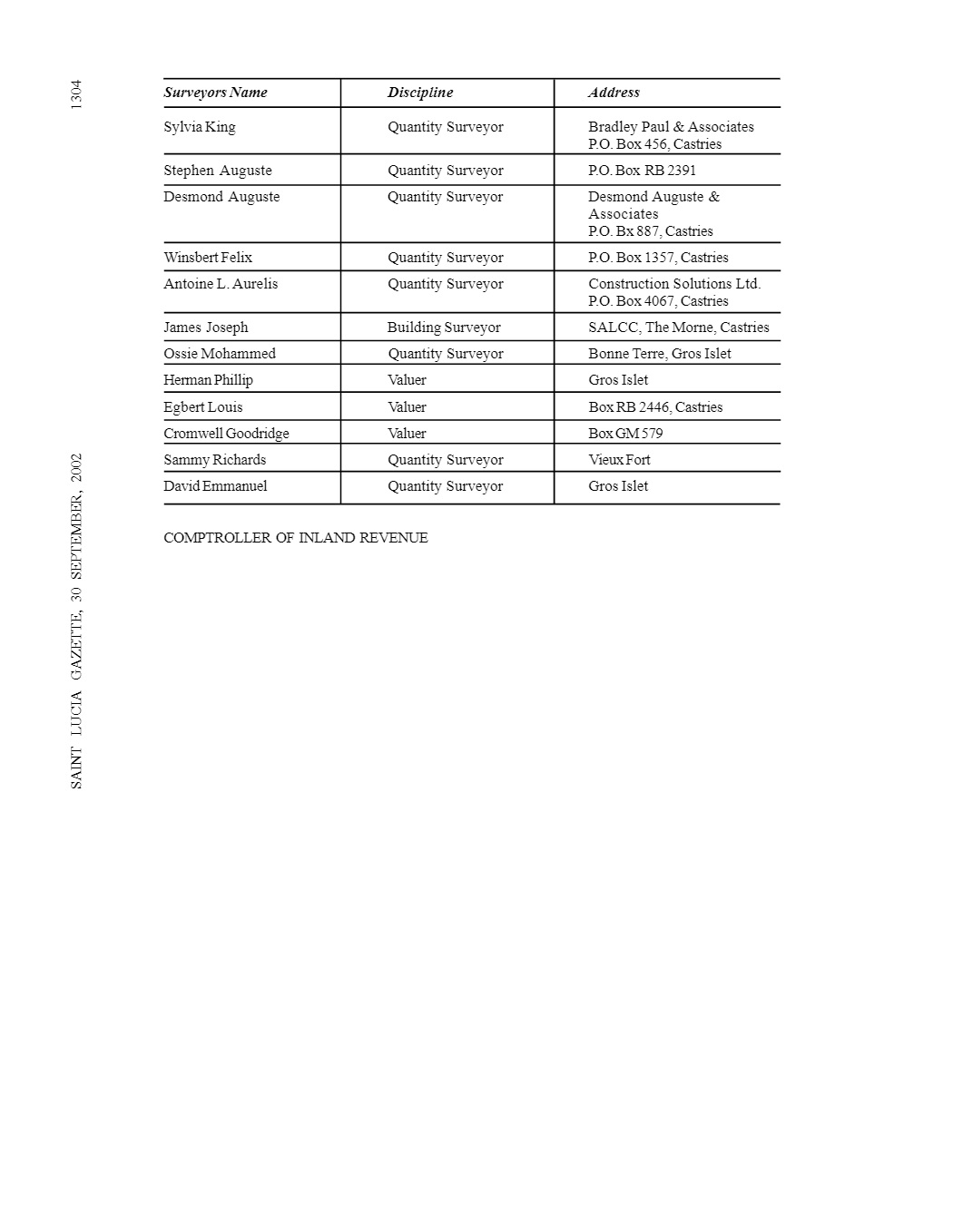

The Commercial valuation report must be prepared by a recognized Valuer.

Please visit our offices/website and Other Agencies for the list of Recognized Valuers.

All Commercial Property Valuations Forms must be accompanied by the following supporting documents supplied by the Valuer:

1. Recent copy of Land Register

2. Site or Location Plan

3. “Method(s) of valuation applied” showing workings/Market data and all analysis.

4. Photos of internal finishes and building elevations

5. Survey Plan

Valuing a Property

Data collected from each property is determined under Valuation Best Practice guidelines and includes but not limited to:

- Land area

- Building size

- Building condition

- Construction material

- Age

- Available service

- Land classification code (usage) and zoning etc.

Data is complied on each property over time, through site inspection, building and planning permits and other public sources.

The valuation surveyor builds profiles of different types of properties in different areas by analyzing recent sales or leases in that area. This information is then applied to individual properties, taking into account the different characteristics of each property.

Tax Rolls

A new valuation roll is prepared every five (5) years and there may be need for the Department to perform valuations between general valuation rolls. These are known as supplementary rolls. They are required when properties are physically changed e.g. When building are altered, erected or demolished, or land subdivided, etc.

The record of all properties is prepared and published every five (5) years in accordance with the Land and House Tax Act.

Land Tax Rates

|

Classification |

Rates |

|

10 acres or less |

Nil |

|

Over 10 acres but less than 50 acres |

$0.25 per acre or part of an acre |

|

50 acres and over but less than 100 acres |

$0.50 per acre or part of an acre |

|

100 acres and over but less than 500 acres |

$0.75 per acre or part of an acre |

|

500 acres and over |

$1 per acre or part of an acre |