Quick Menu

Quick Menu

FATCA

What is FATCA?

The Foreign Account Tax Compliance Act (FATCA) was enacted by the United States (US), in 2010 and compels foreign financial institutions (FFIs) and non financial entities (NFEs) to report on accounts and assets held by US citizens and held by foreign entities in which US citizens hold controlling interests. This legislation ultimately aims to stop tax evasion and to improve income tax compliance.

Saint Lucia & FATCA

Saint Lucia signed a 1A reciprocal Intergovernmental Agreement (IGA) with the US on 19th November 2015. Under this agreement both countries will share information for tax purposes. The Inland Revenue Department (IRD) will collect information and report on qualifying accounts held by US account holders within this jurisdiction and vice versa. Saint Lucia is slated to report for income years 2014 and 2015 by 30th September 2016.

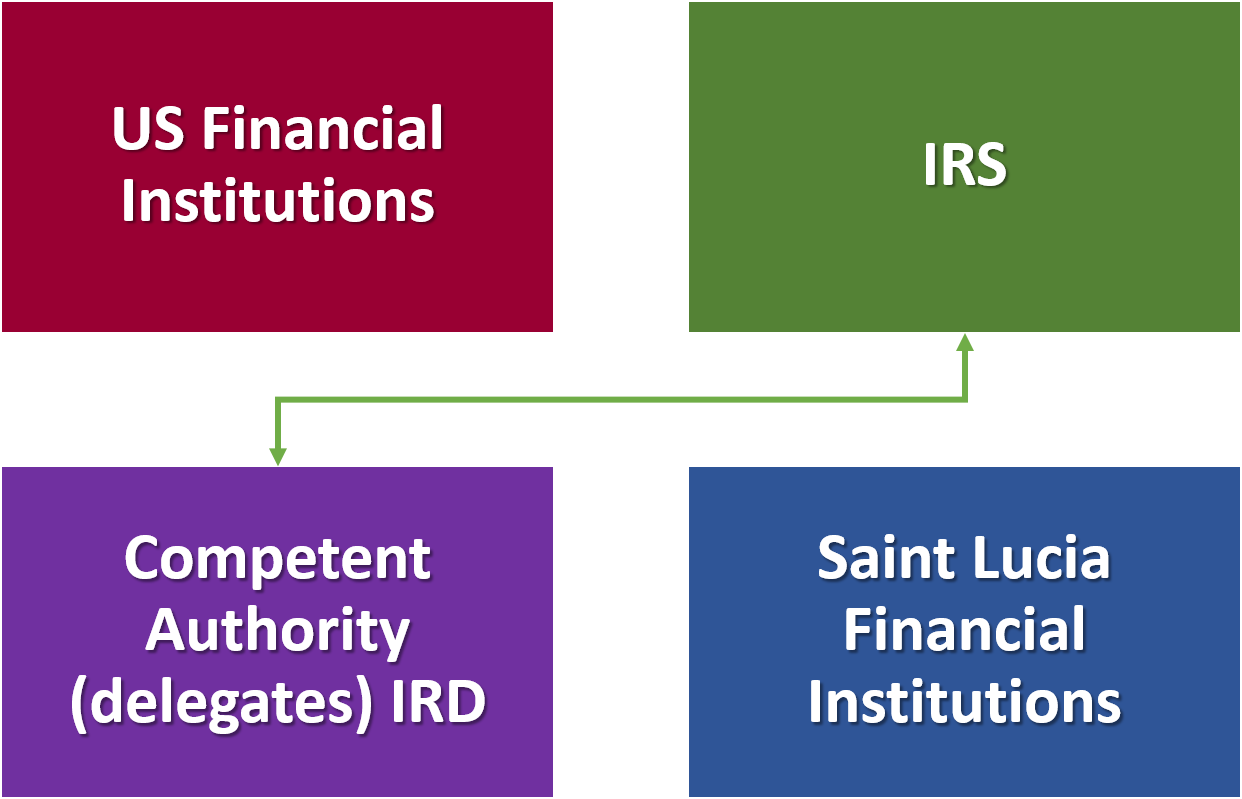

The diagram below shows the flow of information for FATCA. The revenue agencies in both countries collect and share relevant financial account information, obtained from financial institutions.

FATCA Information Flow:

|

Who Will Be Affected by FATCA?

Financial Institutions and Non Financial Entities: The FACTA provides for automatic withholding tax of thirty percent (30%) of all payments due, from US source income, including the gross proceeds of certain sales. to non-compliant FFIs and NFEs.

Such payments include:

- Interest (including IOD)

- Dividends

- Annuities

- Profits and Income

- Salaries and wages

- Compensation

- Remuneration

- Rents

- Premiums

- Emoluments

- Sale or disposition of property that can produce dividends and interest.

- Sale of stock (on gross proceeds even when there is no gain)

- Any other fixed or periodical gains, profit or income which stems from sources within the US.

To avoid this automatic withholding penalty, FFIs and NFEs can sign up with the IRS to provide information on applicable financial accounts with US Indicia. When financial institutions decide to become partners they are expected to:

- Collect relevant information on all accounts holders ( to determine which are owned by US citizens)

- Comply with verification and due diligence procedures

- Report on US account holders

- Comply with reporting requests

Some categories of FFIs are exempted from FATCA requirements. These include:

- Most Government entities

- Most non-profit organisations

- Certain small, local financial firms

- Certain retirement entities

Click the drop-down menu items below for more information.

FATCA reporting in Saint Lucia commenced in 2016. The Table below shows the reporting times and the information that needs to be provided for the next three (3) years and onwards.

2016

|

When to Report |

|

|

September 30 2016 |

FFIs in Saint Lucia |

|

What to Report (with respect to 2014 and 2015): |

|

|

1. |

Account holder’s name |

|

|

For passive non-financial foreign entity, the name(s) of any substantial U.S. owners |

|

2. |

Account holder’s U.S. taxpayer identification number (TIN) |

|

|

For passive non-financial foreign entity, only the TIN(s) of any substantial U.S. owner(s) |

|

3. |

Account holder’s address |

|

|

For passive non-financial foreign entity, only the address(es) of substantial U.S. owner(s) |

|

4. |

Account number |

|

5. |

Account balance or value |

|

6. |

For accounts held by recalcitrant/nonconsenting account holders: report aggregate number and balance or value |

|

7. |

Income paid (except certain gross proceeds from the sale or redemption of property) (2015 reporting) |

2017

|

When to Report |

|

|

September 30 |

FFIs in Model 1 IGA jurisdictions: |

|

What to Report (with respect to 2016): |

|

|

|

Everything reported in (1) through (7) for 2015 |

|

8. |

Gross proceeds paid to custodial accounts |

After 2017

|

When to Report |

|

|

September 30 |

FFIs in Model 1 IGA jurisdictions: |

|

What to Report (with respect to previous year): |

|

|

|

Everything reported in (1) through (8) for 2016 |

Source http://www.irs.gov/Businesses/Corporations/Summary-of-FATCA-Timelines

For Financial Institutions (FI)

All FIs should register with the IRS and obtained a Global Intermediary Identification Number (GIIN), ahead of the first reporting date (Sept 30th 2016). In addition, these entities should pay close attention to the schema provided by the US when developing their reporting mechanisms (http://www.irs.gov/Businesses/Corporations/FATCA-XML-Schemas-and-Business-Rules-for-Form-8966). This will ensure the smooth flow of information once reporting commences.

For further Information

Please contact via email: aeoisupport@ird.gov.lc

Guidelines

IGA

Below is the list of FATCA-IGA agreement documents:

Annexes - These documents are supplementary to the main FATCA agreement between the United States of America and Saint Lucia

Below is the main FATCA agreement drafted between the United States of America and Saint Lucia

Legislation

IRS Notices

FATCA IRS Notice

In accordance with Notice 2015 66, published by the Internal Revenue Service, countries which have not signed an intergovernmental agreement (IGA) with the United States (US) or for which the IGA did not come into force by September 30th 2015, can provide reports for income year 2014 by September 30th 2016. Since Saint Lucia is one such country, reporting with respect to FATCA will commence in 2016.

The notice is available at https://www.irs.gov/pub/irs-drop/n-15-66.pdf.